I started this blog in 2006 and there’s one subject I’ve never broached in over 1,500 postings: Settlements.

There’s a good reason for it, that being that a personal injury lawyer doesn’t really want to be known as the one that settles, but the one that takes a verdict.

If you prepare your case for settlement you are stuck — you aren’t ready for verdict. But if you are ready for verdict can you be ready to settle if the opponent asks that this door be opened. The defense lawyers and insurance companies need to know you are ready for verdict.

I have subject headings on this blog for Bork, beer, baseball and the Boston Marathon, but until this moment, no subject heading for settlements.

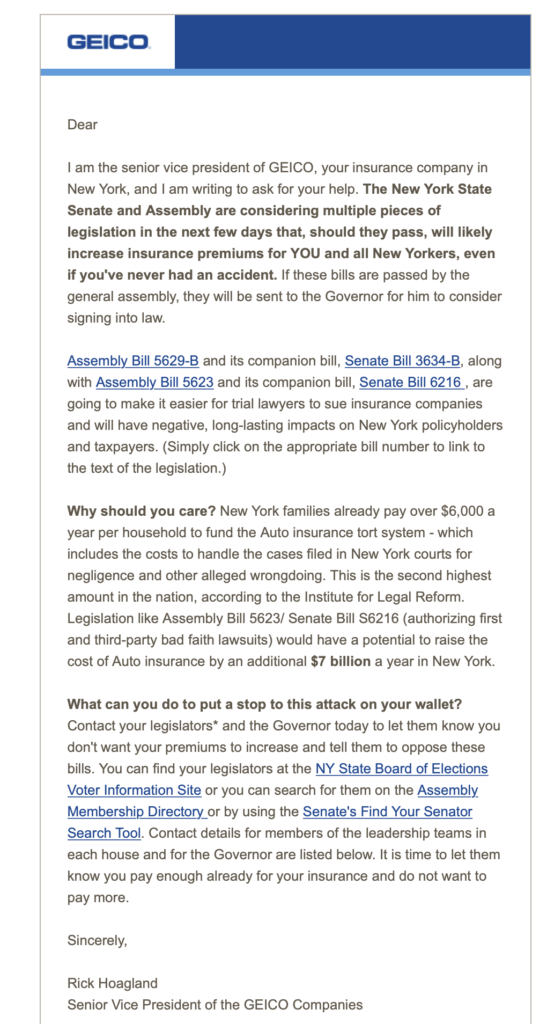

The last Legislative session changes that, however, due to a crucial change in the law related to settlements that passed both the Senate and the Assembly. If Governor Cuomo signs it. He should.

The settlement issue comes up in the personal injury context when you have joint tortfeasors. Assume that Defendant A wants to pony up some money but Defendant B does not. Presently, if you accept the offer from A, then B gets a choice after verdict regarding a set-off. B can either deduct the percentage of liability of A (the equitable share), or the gross amount of the settlement that came from the settling defendant.

This choice is a windfall for B. But worse than simply being a windfall, it actively discourages settlements. Few plaintiff’s want to see themselves stuck after a verdict with Defendant B getting the bonus of this choice. The devilish law is Section 15-108 of the General Obligations Law.

But it’s the public policy of New York, and I suppose every other state, to encourage settlements. It lowers the burdens on the courts, eliminates appeals, and a compromise brings finality.

What does the amendment do? It forces the non-settling defendant to make its choice of the manner of set-off before trial.

The justification of the amendment is:

The key feature of the statute, and the feature most criticized by the statute’s detractors, is that it rewards defendants who do not settle and can penalize plaintiffs and defendants who do. [This leaves] the non-settlor with the choice of an “amount paid” reduction or an “equitable share” reduction.

This benefits the non-settlor in two ways. First, in those instances in which the settling tortfeasor’s payment turns out to exceed what the trier of fact later determines to be the settlor’s equitable share of the damages, the non-settlor benefits by the difference between those two sums. The second benefit accorded to the non-settlor is that the risk of settlor’s solvency, formerly borne by the non-settlor, is now eliminated. The non-settlor is able to deduct settlor’s equitable share whether or not settlor actually could have paid such sum. By virtue of these features, the non-settlor often obtains windfall reductions of liability, usually albeit not always at the plaintiffs expense…This bill would allow the non-settlor the same alternatives as currently exist, but require that the choice be made before, rather than after, trial. The non-settlor still would get to choose whether it will reduce its liability to plaintiff by the amount of the settlor’s payment to plaintiff or by the amount of the settlor’s equitable share of the damages. The difference is that because the non-settlor would have to make the choice before the verdict was rendered, there would be an added incentive to a defendant to settle, rather than to sit back and choose the “best of both worlds.”

Governor Cuomo should sign this common sense legislation. Or build more courthouses and hire more judges.