It’s odd to see an appeals court vacate its own decision, without anyone having asked, but that is what happened here. It’s all about the power of the government to tax personal injury awards.

It’s odd to see an appeals court vacate its own decision, without anyone having asked, but that is what happened here. It’s all about the power of the government to tax personal injury awards.

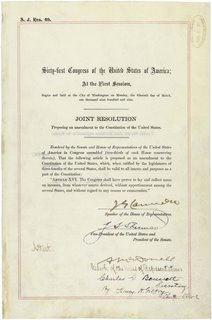

Congress has the power to tax income, but not recoveries for personal injury. Its power comes from the Sixteenth Amendment, which gives it the “power to lay and collect taxes on incomes, from whatever source derived…”

Since a personal injury award, either by settlement or verdict/judgment, is compensation for that which was lost, it is not income. The injured person is simply made whole.

But what of psychological injury or loss to reputation? It was just a few days ago I posted on emotional injuries for witnessing the death of a sibling while in the “zone of danger.” In Murphy v. IRS, a three judge panel of the U.S. Court of Appeals for the District of Columbia held last year that compensation for emotional injuries was not income, and therefore not taxable. Therefore the provision of the Internal Revenue Code that tried to tax the money was held to be unconstitutional as it contravened the Sixteenth Amendment. Much was written on the subject, which I will not repeat, some of which can be found at this link to the TaxProf Blog.

The news? The Court of Appeals reversed itself a few weeks back by tossing out the decision, and asked for new briefs and oral argument. We can thus expect a new decision where the same three judges reverses their prior holding, or perhaps strengthens that prior opinion with the knowledge that, one way or another, this may well be headed for the U.S. Supreme Court. Interestingly, the court’s request for a re-hearing was done on its own motion. The losing side, the government, had not asked for that, but rather, an en banc hearing (with all the judges for the circuit court).

Since almost all personal injury cases have an element of psychological damage (the “suffering” in “pain and suffering”), the outcome is more than a little bit important. Will the court try to distinguish the emotional damage one has with a lost limb from that of the suffering in a non-physical injury defamation case? If a person has any physical injury to go with the emotional damage, does that mean all of the emotional damages are tax exempt? Will juries now be asked to separate out the two components?

The government argument is that all compensation from a personal injury suit may be taxed, notwithstanding the Sixteenth Amendment. This next appellate argument is unlikely to be the last…stay tuned…

And a tip of the hat to John D. Darer at StructuredSettlements4Real, where I caught up with that information.