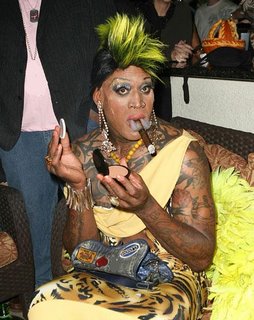

An issue has arisen in recent years about the taxability of personal injury settlements when a confidentiality agreement is reached. Generally, such settlements are not taxable pursuant to IRS section 104(a)(2). But the issue reared its head due to a settlement involving Dennis Rodman back in Amos v. Commissioner of Internal Revenue when Rodman kicked Amos, a camerman, in the groin during a Chicago Bulls game. (Amos-v-Commissioner.pdf)

An issue has arisen in recent years about the taxability of personal injury settlements when a confidentiality agreement is reached. Generally, such settlements are not taxable pursuant to IRS section 104(a)(2). But the issue reared its head due to a settlement involving Dennis Rodman back in Amos v. Commissioner of Internal Revenue when Rodman kicked Amos, a camerman, in the groin during a Chicago Bulls game. (Amos-v-Commissioner.pdf)

Prior to suit they reached a $200,000 settlement. But part of that settlement included a confidentiality clause. So the IRS brought an action claiming that part of the settlement was taxable. And the Tax Court agreed, ruling in 2003 that while the proceeds for the personal injury portion were not taxable, that any part of the money that was in exchange for the confidentiality agreement would be. The court wrote that “if a settlement agreement lacks express language stating what the amount paid pursuant to that agreement was to settle, the intent of the payor is critical to that determination.” In the end, the court ruled that Amos was to be taxed on $80,000 of the settlement.

And so that opened up any personal injury settlement that includes a confidentiality clause to potential scrutiny. So what’s a lawyer to do? (Question courtesy of Drug and Device Blog.)

While others have suggested placing a number, perhaps $1, in the agreement on the value of the confidentiality agreement — part of the “express agreement stating what the amount paid pursuant to that agreement was to settle” — I think an issue still lurks. It seems quite possible — and I say this without much in the way of knowledge of tax law — that the IRS would want to go to the merits and look at the actual injuries and compare that to the amount received if they believed a great disparity existed between injuries and recovery. It seems that a $5,000 injury that resulted in a $100,000 settlement, for example, would raise eyebrows regardless of what the legal papers claim.

But the problem really exists if it is simply the defendant that seeks the agreement, as has traditionally been the case. The defendant doesn’t want to be seen as a mark to other potential litigants.

The internet age and issues of privacy and identity theft, however, shift that dynamic. Would a plaintiff receiving a large award really want the information public? Likely not. In fact, at my firm’s web site where I discuss case resolutions I have stripped out the names of my clients for just this reason. Those recoveries are no one’s business but the parties themselves.

And so the solution for an attorney to explore with the settling client — I’m not a tax lawyer and this is not tax advice, disclaimer, disclaimer, yada, yada, yada — is actually somewhat simple: Both sides are seeking that confidentiality agreement. The consideration for the confidentiality agreement is the mutual promise for confidentiality. Plaintiff, simply put, doesn’t wish to alert potential thieves and hustlers that such funds exist. This is a real issue.

(Addendum: The preceding “simple” analysis may well be wrong, as the IRS might still say it has value and tax it.)

Along these same lines, an attorney should be wary of signing any agreement that says the funds are being paid to dispose of a claim was dubious, frivolous, meritless or any such other claptrap. Incredibly, I have seen releases written that way. (“But that’s our standard release, everyone signs them!”) Signing such a document could be seen as an admission that the amount paid was for something other than personal injury, and therefore subject the client to taxation.

(Second Addendum): The safest course of action may be to take back a Hold Harmless agreement from the defendant. That is to say, if they wish to have the confidentiality agreement, then they must also agree to defend and indemnify the plaintiff if the IRS comes calling, and claiming that there was value in the confidentiality agreement.

And yes, I did have fun doing an image search for Dennis Rodman.

See also: More On Taxation of Confidentiality Agreements (Drug and Device)