The Journal News today publishes my op-ed on tort “reform.” This is a regional paper owned by Gannett that serves the commuter counties north of New York City.

The article is here: Want to cure high malpractice rates? Target bad doctors

A copy is here: Turkewitz-Tort-Reform.pdf and reprinted below:

———————————-

Re “Tort reform needed in New York state,” a July 23 letter by Cortes E. DeRussy of Bronxville that blamed the “trial-bar friendly state Legislature” for refusing to enact malpractice reforms needed to keep doctors from fleeing the state:

The DeRussy letter repeated a common myth in an argument for tort “reform,” claiming that one of the primary reasons for increased medical malpractice insurance was “unusually high judgments.” DeRussy couldn’t be more wrong. Last year doctors in the state were hit with a 14 percent increase in medical malpractice rates. The instinct among those who want to change the tort laws by granting some level of immunity or protection to the wrongdoers was to blame the lawyers or juries. A little protectionism called tort “reform” in the way of artificial caps on awards would surely cure this problem. Right? Except that medical malpractice verdicts had nothing to do with the increase in rates. Rather than make simple conclusory statements, let’s look at some actual facts:

New York Superintendent of Insurance Eric R. DiNallo, who sets the amount of rate increases, said last year that the 14 percent jump comes “after years of artificially low rate increases” and that “the rate increase comes after years of setting rates below what was needed.” The rates were raised in order to avert a possible “irreversible crisis.” Did doctors previously complain that their rates were too low?

New York had previously “appropriated” $691 million of medical malpractice insurance reserves from the Medical Malpractice Insurance Association to balance the state budget. This association had been established by the state to satisfy any deficiencies attributable to the premium levels for malpractice policies, and for reinsurance. That surplus would have been used (if not taken during the Pataki administration to balance the state budget) for maintaining the solvency of New York’s medical malpractice insurance carriers.

OK, so the problem was caused by lousy state policy under the Pataki administration by setting artificially low rates, while also swiping the doctors’ rainy day fund. Surely, the problem was also caused in part by increasing medical malpractice cases and payouts, right? Well, no. In fact a study has shown that the number of medical malpractice cases in New York has remained static, and the amount of payouts has kept pace with other health-care costs. When premiums go up, but the payouts are flat, you know you have a problem. But that is not problem that was created by those who were injured by negligence, nor by their counsel.

And have high medical malpractice insurance rates in downstate counties chased away physicians, as the fear-mongers suggest? Not even close. It seems that the number of doctors in New York jumped by 16 percent from 1995-’03, an increase greater than our growth in population. And The New York Times reported just last year that while there was a 6 percent growth in the number of doctors from 2001 to 2005, for a total of about 77,000 doctors, the way they are spread throughout the state is wildly uneven.

Perhaps the problem is an onslaught of frivolous litigation? Nope, not that either. A report in the New England Journal of Medicine disproves the myth of frivolous malpractice litigation. Here’s a suggestion for tort “reformers” like DeRussy, who wish to create artificial one-size-fits-all caps for the victims of negligence: Government clearly created this insurance problem, as DiNallo admits. We, therefore, need insurance reform. Trying to fix a government-created problem on the backs of the most badly injured New Yorkers is not only cruel, and not only lousy policy, but it also won’t work. For it wasn’t the victims who created the problem. (It’s worth noting, by the way, that New York already has caps on personal injury awards, including medical malpractice.*)

Now here is a reform that the doctors may want to entertain: With up to 98,000 people per year dying from medical errors according to the Institute of Medicine, and with 4 percent of the state’s doctors contributing to half of the malpractice suits and payments (according to a Public Citizen report) maybe, just maybe, a little more policing of the medical profession might be in order to weed out the bad apples?

A good way to start real reform would be to take the rainy day fund money back from the general fund where it had disappeared. That means, however, a responsible state government engaging in sound budgetary policy instead of shell games. Better policing of the few doctors who do most of the damage is the second avenue that the state must embark upon, and not just for the sake of insurance premiums but for the sake of future patients who may come under their care.

The writer, who lives in New Rochelle, is a Manhattan attorney and the author of the New York Personal Injury Law Blog.

——————————————————–

*Updated: As I sat in court this morning I read through the op-ed and saw that they made edits due to length. One in particular is noteworthy, since it may lead the reader to a wrong impression with respect to New York’s caps on personal injury cases:

As it appears in the paper:

(It’s worth noting, by the way, that New York already has caps on personal injury awards, including medical malpractice.)

As it was written and submitted:

It’s worth noting, by the way, that New York already has caps on personal injury awards, including medical malpractice. But they are not one-size-fits-all. First there are members of the community that sit as a jury. Then if the award is too high (or too low) the trial judge can order a new trial if s/he believes the award shocks the conscience of the court. Then there is a third level of review at the appellate level, where a verdict that is too high (or too low) can be thrown out if it deviates materially from what would be reasonable compensation. These standards are designed to fit the particulars of the case, and have proven to be ample safeguards since at least 1812. And that is how it should be.

Correction: In one portion of my piece I note that 4% of the doctors are responsible for 50% of the lawsuits. That should read 50% of the payouts. That doesn’t affect any of the discussion of Insurance Department errors, of course, or the fact that a small number of doctors are responsbile for a huge percent of the problem, but it is put here for accuracy. (Via Overlawyered, see comment 4.)

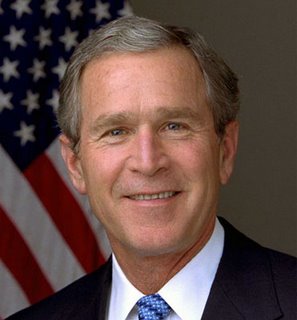

Hypocrisy again. Addressing the nation just a few minutes ago, George Bush claimed this as a long held belief:

Hypocrisy again. Addressing the nation just a few minutes ago, George Bush claimed this as a long held belief: